Empowering BIPOC Communities with Innovative Real-Estate Platforms

ABOUT US

Build Generational Wealth

Our Core Services

Residential Flips | Long-Term Rentals | Wholesaling | Land Development

Harness our proprietary analytics engine and 3D scan modeling to identify under-priced properties, forecast renovation costs in real time, and execute targeted value-add improvements—unlocking maximum upside and top-tier returns.

Leverage dynamic pricing algorithms, rent-growth projections, and hyper-local market intelligence to structure long-term rental portfolios that maintain premium occupancy levels and drive consistent cash-flow performance.

Deploy the AI Deal Machine for off-market discovery, instant underwriting, and CRM-driven investor matching—while using GIS-assisted site analysis and automated entitlement workflows to transform raw parcels into community-focused developments.

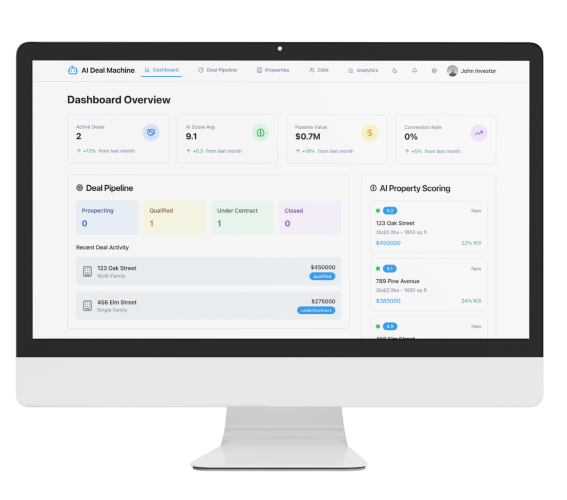

AI Deal Machine & CRM

Our AI Deal Machine harnesses advanced algorithms to scan public and proprietary data sources, automatically identifying high-potential properties and generating detailed underwriting models in real time. Integrated into our CRM, every lead, interaction, and investor touchpoint is routed through a unified workflow—ensuring personalized follow-up, streamlined deal management, and transparent visibility at every stage.

Early access available Q4 2025.

Keep wealth where it belongs—launching Q3 2026

Introducing Equity Nexus™

Equity Nexus is our BIPOC-First Real-Estate Platform that keeps homes, businesses, and assets within BIPOC communities:

Pre-qualified BIPOC buyers, sellers, and investors connect over deals scored for both financial return and community benefit—ensuring every transaction uplifts neighborhoods.

A secure digital repository for wills, trusts, and key estate documents—helping families protect assets, streamline probate, and preserve wealth across generations.

On-demand courses, live workshops, and one-on-one coaching in financial literacy, estate planning, and business succession—equipping BIPOC participants with the knowledge to acquire, manage, and pass on real-estate wealth.

What we offer

Our Six-Step Solution to BIPOC Wealth Barriers

We uncover traditional bank loans, credit-union programs, community development finance, co-investment pools, and alternative funding structures—ensuring you secure the right capital for homes, businesses, and ventures.

Tailored coaching and automated tools help repair and build credit, unlocking lower-cost financing.

On-demand courses and live workshops close financial-literacy gaps in deal analysis, budgeting, and investment strategies.

Built-in digital tools and templates simplify wills, trusts, and ILITs, shielding family assets from probate.

Proprietary algorithms scour off-market data and deliver instant underwriting via our CRM, ending fragmented deal searches.

A vetted marketplace and mentorship network connects BIPOC buyers, sellers, and investors, replacing isolation with peer and expert support.

Why Choose Us

Why Choose Equity Row Co.

We prioritize BIPOC retention, not just transactions.

AI Deal Machine and CRM automate research, outreach, and reporting.

Financial-literacy and estate-planning built into every client journey.

Our success fees and co-investment carry ensure our incentives match yours.

FAQ

Most Popular Questions

We provide end-to-end support across the entire wealth-building ecosystem: buying and selling real estate, sourcing off-market deals, crafting development plans, and managing marketing & advertising campaigns. We also offer 3D property scanning (interior & exterior), turnkey design services, website creation, credit repair coaching, and ongoing community connections—for small businesses, entrepreneurs, families, e-commerce brands, and real-estate investors.

Our AI Deal Machine continuously crawls public records, MLS feeds, and proprietary data to surface high-upside opportunities. It delivers instant underwriting models directly into our CRM, so you never miss a deal—and you can compare scenarios side-by-side.

We offer on-demand courses, live workshops, and one-on-one coaching in financial literacy, credit repair, deal analysis, estate planning (wills, trusts, ILITs), and business succession planning—empowering you with practical skills at every stage.

Equity Nexus™ goes live Q2 2026, and the AI Deal Machine + CRM integration releases Q4 2025. Sign up for our early-access list today.

We begin with a full audit of your credit reports to identify errors, outdated information, and improvement opportunities. You receive a tailored action plan—complete with dispute-letter templates, automated monitoring tools, and one-on-one coaching—to raise your score within 3–6 months. As your profile strengthens, we leverage our network of banks, credit unions, CDFIs, SBA-backed programs, impact-focused co-investors, revenue-share structures, and grants to assemble a bespoke capital stack of debt and equity. Our team manages all communications with bureaus and lenders, negotiates optimal terms, and continues to monitor your credit health post-funding—advocating for rate reductions and refinancing when advantageous. By combining hands-on credit restoration with proactive funding placement, we empower you to secure the most affordable capital, accelerate your real-estate or business venture, and build generational wealth with confidence.

Equity Nexus™ is designed for BIPOC homebuyers, small-business owners, e-commerce entrepreneurs, and families who want to acquire, manage, and pass on real-estate and business assets. All participants are vetted to ensure mission alignment and community impa

Our secure digital vault lets you store and organize all critical documents—wills, trusts, insurance policies, property deeds, and business agreements—in one encrypted, family-accessible portal. It streamlines probate and protects generational wealth.

Click “Get Started” at the top of this page, complete the contact form, and we’ll reach out to schedule a free strategy session. Let’s build generational wealth together!